The value of minutes.

In the first article we looked at why teams should aim to have an established core of players.

This blog will look at why being able to anticipate who will play those minutes is key to the success of a club.

As we saw a major factor of success, particularly in the EFL, is to have a first choice XI who play most weeks.

When teams sign players there should always be a plan for how that player is going to be used.

As a first-choice player, expected to play every game when fit.

As a back-up player to provide cover and be sufficiently good that they are not a significant downgrade.

A development player not currently good enough for either a starting or a backup role but with the potential to reach that with the right development.

How good the decision-makers are at anticipating the minutes these players will play, not only in the next season but in the seasons that follow will be vital to the club’s development over time.

We therefore need a framework for the club decision-makers to use to see how good they are at forecasting how many minutes players will play in future seasons.

Our suggestion is this is done by calculating the financial value of time on the pitch.

Our first question is, what is the financial value of one minute on the pitch?

To calculate this we need to establish what the club’s player wage budget is.

In a 48 game season (league plus first round of major cups), with 11 players on the pitch (and ignoring injury time and additional cup games) each League One team anticipates having a combined 47,520 of minutes played that require playing.

If we take an average League One wage budget to be £3m a year (some will be more, some less) then we can say each minute on the pitch has a value of £63.

This will be roughly £42 in League Two with a £2m wage bill.

And with a £25m wage bill a Championship minute has a value of £526

In the Premier League with an average £100m wage bill and a 38 game season, each minute played has a value of £2658.

Of course these are just average wage values. Each club can then take their own specific player wage bill and find their individual value per minute played.

We then need to find out what a good sized squad is and allocate the spending within it.

Squad makeups

Looking at the League One minutes played, and also accepting teams play different formations we can see the average squad makeup of played minutes is:

Goalkeepers :Range: 1-3: Median 2

Centre backs: Range 2-8: Median 5

Fullbacks: Range 2-6: Median 4

Centre Midfielders: Range 3-8: Median 5

Attacking Midfielders/Wingers: Range 2-8: Median 4

Strikers Range 2-8: Median 4

This gives us 24 players who would be considered the first-team squad. We will ignore youth players at this stage although of course they could be promoted to the 24 man squad or provide cover.

Allocation of minutes

Not all 24 players will play the same number of minutes.

Indeed, as we’ve seen, the better run teams tend to have a smaller core of regular starters supplemented by backup players capable of rotating in when required.

So let us assume we want a core of 12 players playing 2500 minutes each and the other 12 averaging 1295 minutes each.

We need clear first choices and second choices for each position.

Anticipated minutes x Value of minutes

We can now do some calculations for our hypothetical League One club with a 24 man squad and a £3m player wage budget.

A League One first choice player should play 2500 minutes at a value of £63 a minute. An annual value of £157,500.

A backup player should be recruited on the basis of being able to play 1295 minutes at £63 a minute. This gives us an annual value of a backup player of £81,585.

These salary brackets should be seen as averages for first-choice and back-ups. It is the case that strikers earn more than full-backs.

However In the simplest terms if the annual cost of the player is less than the monetary value of anticipated minutes played the player is an asset, if the cost is more, then they are a liability.

Why anticipated minutes and not actual minutes?

If the back-up player isn’t played because the first choice player is ever-present then it would seem harsh to call them a liability, they are supplying a service, it just hasn’t been required. Likewise, if a first-choice player is seriously injured that is unfortunate, not poor squad planning.

There are players who will be liabilities though:

- All non-playing squad members outside the 24 man squad.

- A very expensive player will never be able to recover the value of their minutes if their annual cost exceeds the value of total minutes available in a season.

- An anticipated first-choice player who doesn’t retain first-choice status, whilst on first-choice wages.

A framework for measuring recruitment success

We generally use our squad score system for evaluation of the financial viability of a squad.

Whilst the squad score is great for giving an overview of a squad what we are really interested in doing is ensuring that each position has a clear first choice and back up. It is no good having 5 perfectly good goalkeepers if you don’t have any midfielders you are happy to play.

We also need to measure the predictive power of the club decision makers.

Whilst it is good to have a clear idea of the starting XI for the next season it is far better to be able to accurately predict the starting XI two or three seasons ahead.

At League One level most contracts will be two, perhaps three years.

However Premier League teams are often giving out five year contracts.

There are two reasons for this; protecting the value of a desirable asset, and operating in a competitive market with a small pool of talent good enough to play at that level. However, get this wrong and it can be VERY expensive. A single mistakenly awarded 5 year Premier League deal can cost £20m over the lifetime of the deal.

Why you should calculate player value in anticipated minutes

Every contractual decision made on a player should be seen as a bet on their future contribution of minutes played.

The ideal transfer is where the player joins, plays every minute, and is sold for a higher fee than was paid for them at exactly the point where the club feels their financial cost will outweigh the value of minutes they will contribute in the future.

We don’t expect those deals to happen all the time. In fact the most important part of being a club decision-maker may be to reduce the downside risk.

Example:

A player is identified.

The club assess him as a first choice player and have calculated the maximum they can pay for such players is £150k a year.

The player is 28 years old, signed for no fee, and signs a 3 year contract on £120k a year.

The 3 year cost is £360k.

At £63 a minute this means the club anticipates a total of 5714 minutes of played minutes over those 3 years.

After 2 years the player has played 7000 minutes. He demands a new 3 year contract on £200k a year.

At first glance this is reasonable, he has clearly exceeded expectations. Playing 7000 minutes where only 3800 had been anticipated.

There are 3 options:

- Sell the player whilst under contract in hope of a fee and removing the final year of their contract from the wage bill.

- Retain the player for their final year and lose them on a free transfer at the end of the deal.

- Agree the new deal on £200k a year for the next 3 years.

We can put values on this in anticipated minutes terms:

If a transfer offer is received the amount offered (£X) should be added to the players wage (£120k) to calculate the anticipated minutes needed to be played in the final year to justify rejection.

At an offer of £0 and a wage of £120k accepting the offer is worth £120k, he needs to play 1900 minutes to justify his wage left in his remaining year.

A £50k cash (plus wages) offer is worth £170k and raises the required minutes to 2700 minutes.

At £100k the offer is worth a total of £220k, a player would need to be playing 3500 minutes a season. This is in line with his played minutes from the past 2 seasons.

Agreeing to the new 3 year deal at £200k a year should be seen as a total cost of 3 x £200k (minus £120k of saved wages from the existing contract) so a total cost of £480k over 3 years.

This equates to anticipating the player will play 7620 minutes over the next 3 seasons.

He might just about manage this but it is a gamble, the best case scenario is he just about breaks even. The downside risk is he gets injured, or loses form dramatically and you are stuck with an unwanted player on way above what you would want to pay for a first team player.

Given what we know you would be best to either retain the player for the next season on his existing contract , or if an offer of around £100k is made selling the player immediately. A new contract would only make sense if wage demands dropped and a value was agreed that reflected future anticipated use that factored in the player age, and the alternative options both within the squad and on the market.

Assessing skill at anticipating minutes over time

Each contractual negotiation is effectively a bet where the club need to try and get the value from the anticipated minutes played to be higher than the total value of the contract.

In every case the upside is having a player who will be able to contribute on the pitch, and ideally become a sellable asset.

The downside risk of every player given a contract is that they are not able to contribute to the playing squad and become a financial burden.

It is therefore vital that clubs have a methodology in place for assessing if the “decison makers” who make the final call on transfers and contracts are performing at market level or better.

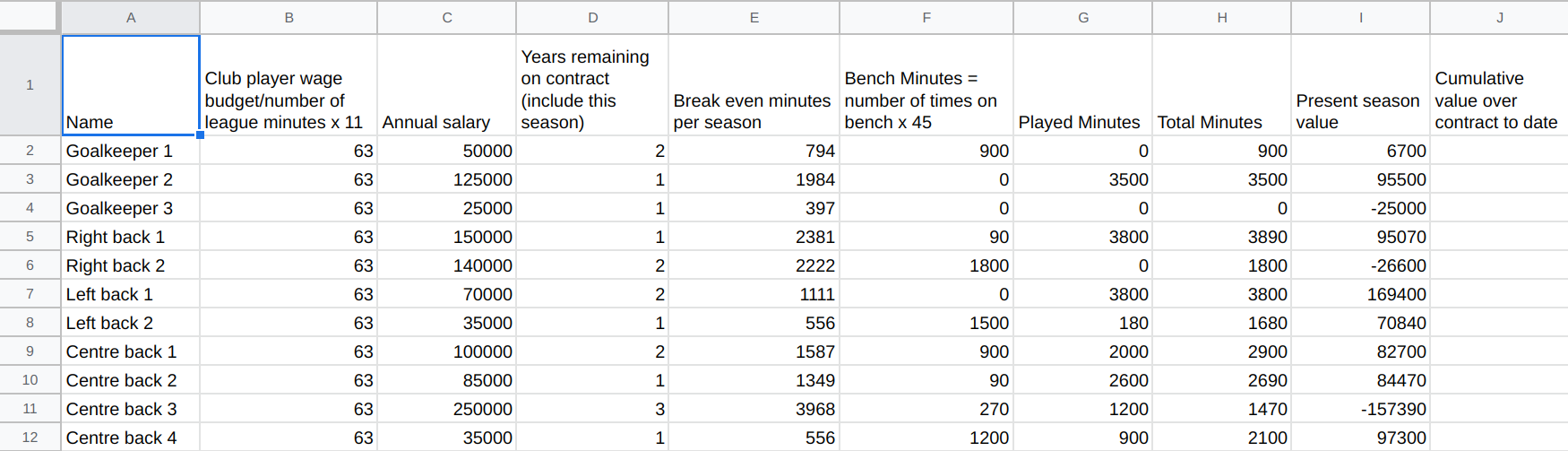

The way we propose clubs do this is a simple spreadsheet examining the various elements discussed in this blog. Looking at the value of each minute played on their team, the players wage, how many minutes they’d played, and therefore their “net present value” for the current season.

Bench minutes are an important feature. If a first-team player is playing every game their “back-up” won’t play. This doesn’t mean they have no value. Each appearance on the bench is therefore rewarded with 45 played minutes, which over a season, will reward a reserve player with a suitable value.

Over time the better run squads will have more players with high positive values and fewer major losses. The cumulative value column will give the best overview of the teams that have extracted the best value from their available budgets over time.

Nobody can see into the future, but having a core of people with the tools and mindsets to make more accurate predictions than average may just be enough to build up a successful team.

Leave a comment